Introducing:

A simple way to manage your money

(It's better than a budget. It's a dynamic spending plan.)

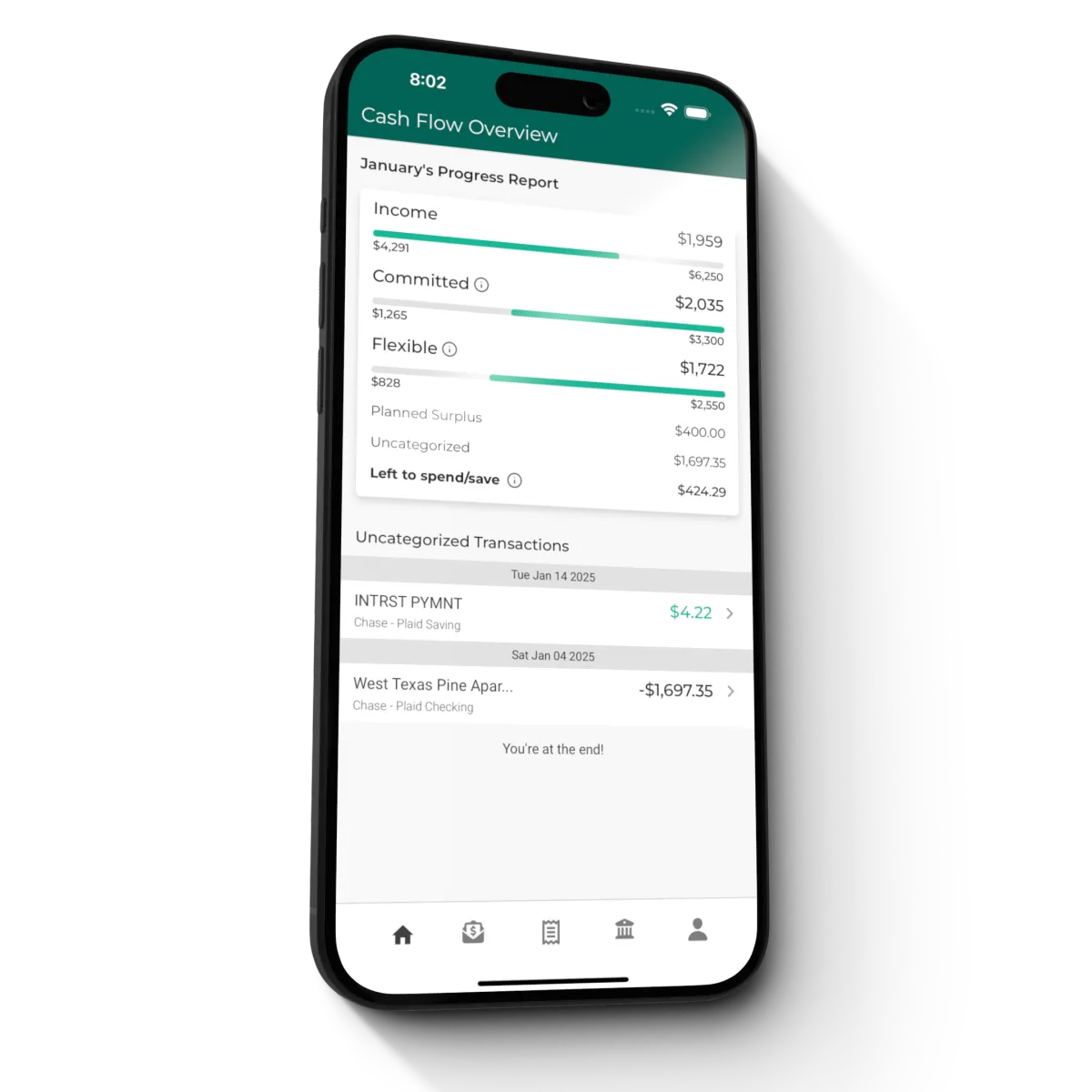

Track Every Transaction

Some automation is good. But too much automation can hurt you. We sync the transactions so you can easily sort them and see where your money is going.

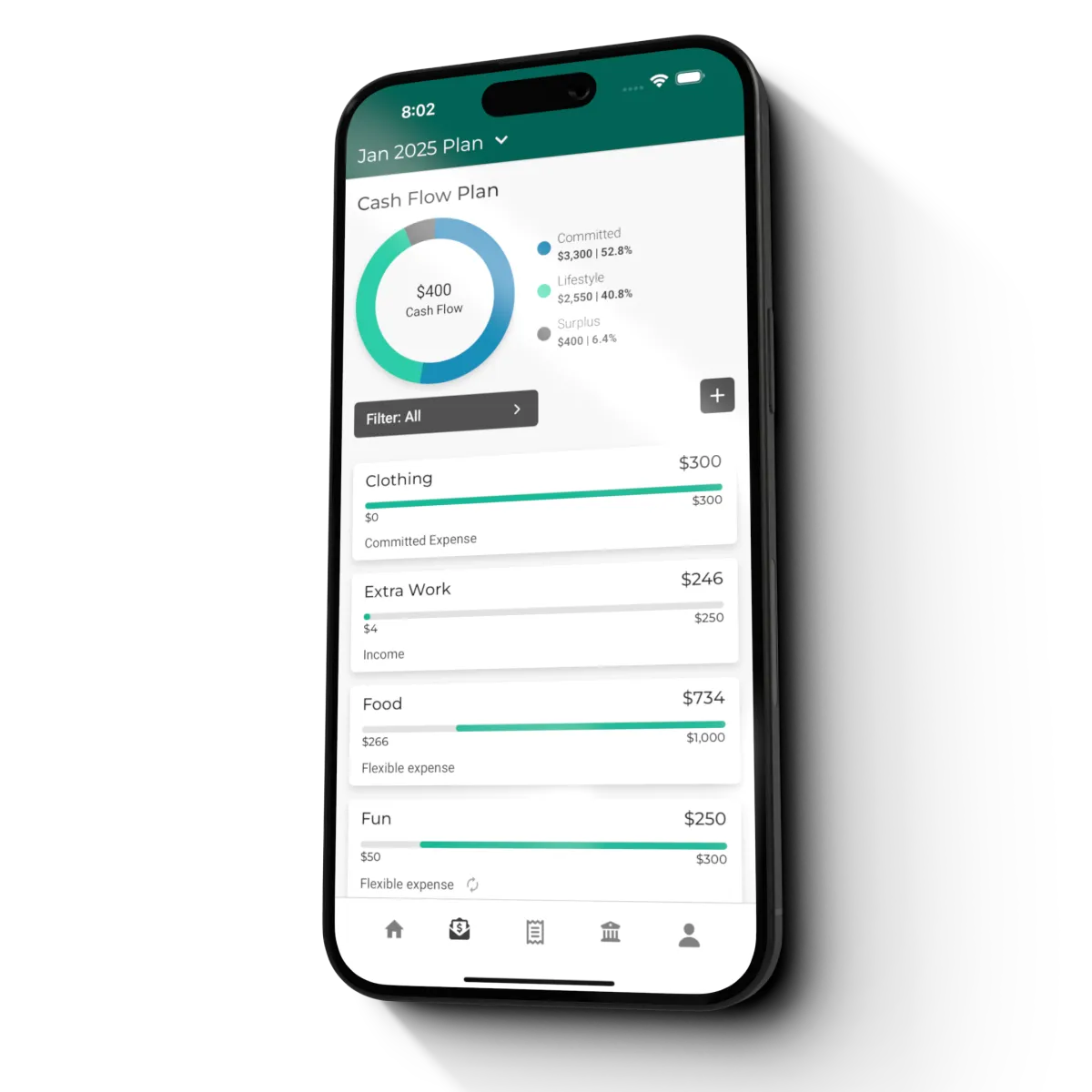

100% Customizable

Who are we to tell you what your spending plan should look like? Get as detailed as you want. Keep it as simple as "wants" and "needs." Your spending plan should make sense to you.

Manually Sort Everything

Get all transactions automatically downloaded for you so you can manually sort them into your categories (and know where your money is going).

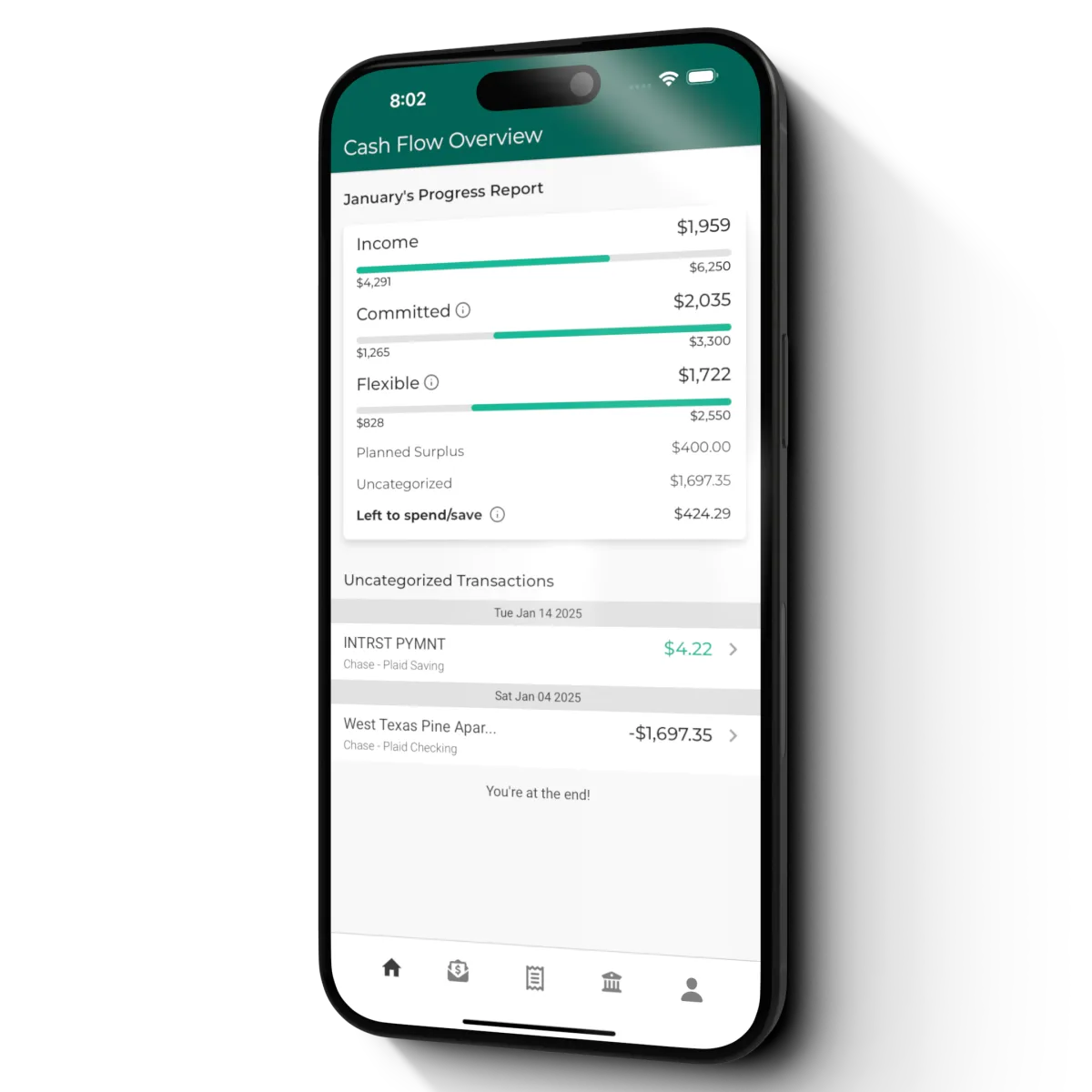

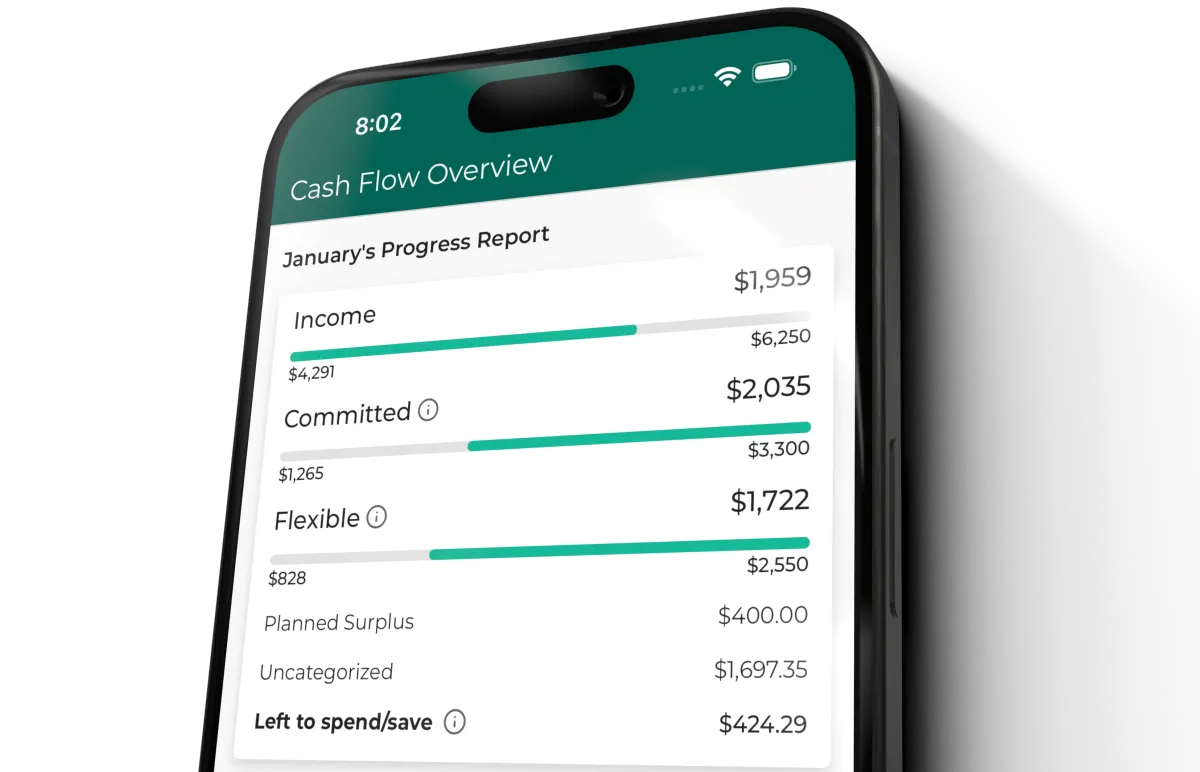

Simplified Down to One Number

We take your total income, minus any committed expenses (e.g., mortgage, car payments, etc), minus the flexible spending you have already spent, and let you know how much you can spend/save for the rest of the month.

Easily Balance Your Plan

You don't need to account for every single penny in your spending plan for it to work. You just need to spend less than you make. If there's extra, great! It will naturally make its way to savings.

How It Works

Make Healthier Money Decisions

(We designed it to help you make healthier money decisions)

Step 1: Connect Your Accounts

Securely connect to your bank or brokerage accounts through Plaid so you can see everything you need in one place.

Step 2: Create Your Spending Plan

Create your custom spending plan so it makes sense to you. Separate your expenses between "Committed Expenses," which are expenses that have little to no wiggle room, like a mortgage, car payment, etc, and "Flexible Expenses," which are expenses that have more wiggle room, like food, dining, shopping, etc.

Step 3: Manually Sort Transactions

If you manually sort every transaction, you'll have a better idea of how much you are spending and where your money is going. We want you to raise your awareness so you can identify what's working and what needs to change.